- Satellite broadband coverage is hindered by capacity and latency limitations

- Consumer satellite internet costs remain high compared to fiber

- Despite its challenges, the satellite market is poised to keep growing

More satellite broadband deployment is on the horizon following revisions to the $42.5 billion Broadband Equity, Access and Deployment (BEAD) program. But whether satellite can get the job done quite like fiber remains up in the air - no pun intended.

Satellite lacks bandwidth capacity

Bandwidth capacity – or lack thereof – is still the biggest obstacle in reaching widespread satellite coverage. SpaceX’s Starlink for instance has excess network capacity in only about half the U.S., elsewhere customers are often stuck on a waitlist to receive service. Even if the Federal Communications Commission (FCC) allocates more spectrum for satellite providers, it won’t be enough to solve the capacity bottleneck, Arun Menon, lead analyst at MTN Consulting, told Fierce.

We don’t know yet how many satellites will be used to connect BEAD locations. But the more satellites there are in the sky, the more “complex coordination” is required for them to avoid interference with each other and ground-based systems, Menon added.

Satellite has higher latency and packet loss

Satellite service suffers from higher latency and packet loss compared to a standard fiber connection. Users can do basic tasks like web browsing, email and even some HD video streaming, but they’ll likely run into data caps if they’re gaming, video-conferencing or using some other high-bandwidth application, Menon previously told Fierce.

In other words, he thinks satellite broadband needs “substantial technological advances” to become a true fiber alternative.

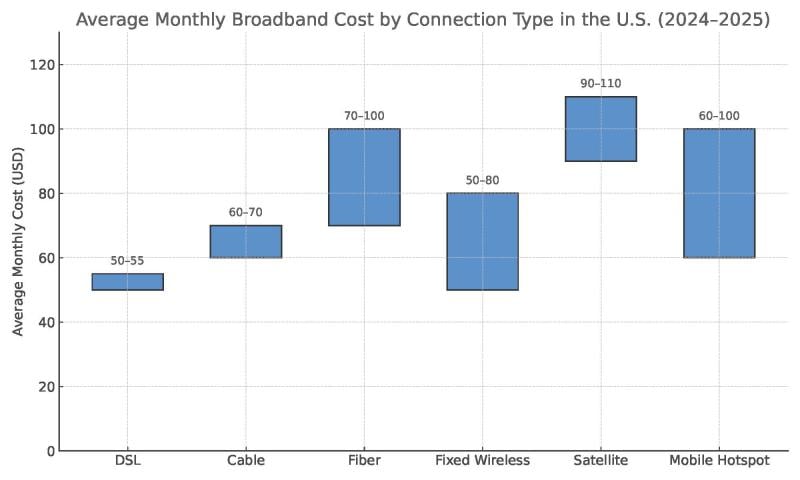

Satellite costs more than fiber and 5G

Proponents of satellite broadband frequently bring up how it’s much cheaper for rural internet deployments than fiber, as the cost to lay fiber cables typically goes up in areas with low population density. It’s true a satellite connection doesn’t require the same extensive construction – merely a modem and a dish at each location – but it won’t come cheap for the consumer.

Starlink gear has an upfront cost of $349, on top of the data plan which starts at $120/month. The company earlier this year did launch a “Residential Lite” offering that costs $80 per month, but it’s still quite a hefty price for what’s supposed to be an affordable broadband option.

The price of fiber broadband meanwhile varies between $50 to $200/month, and fiber ISPs typically provide the customer premises equipment (CPE) at no extra cost. Additionally, data, particularly from satellite-based non-terrestrial networks (NTN), can potentially be more expensive than that on terrestrial 5G. Mobile Experts principal Joe Madden estimated data from providers like AST Mobile to cost between $5 to $9 per GB, compared to roughly $0.30 per gig for a typical 5G plan.

How big is the satellite market?

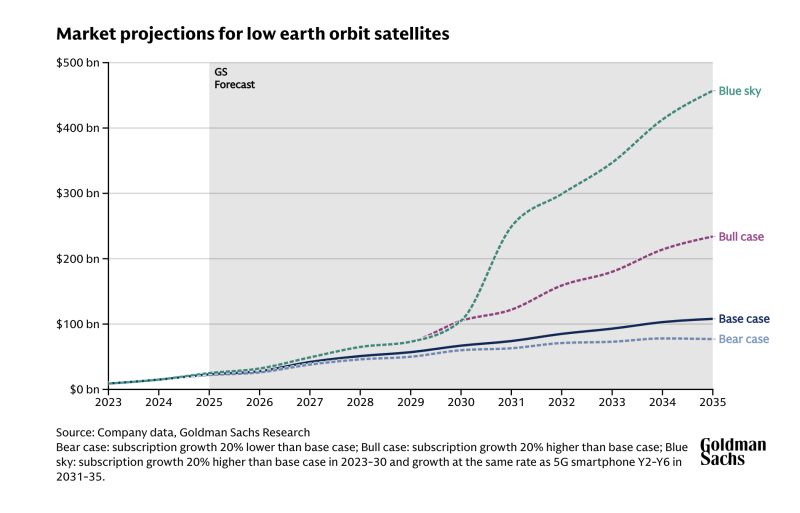

Technical kinks and cost barriers aside, analysts believe the satellite market is poised to see explosive growth in the coming years. Goldman Sachs projects the market for satellite services could reach a whopping $108 billion by 2035.

What's Fierce Network's take on satellite broadband?

Today, satellite broadband can offer an alternative for rural areas where cable and fiber access networks don't exist. In fact, analysts from Mobile Experts and Ookla have told us that satellite is up to snuff when it comes to video conferencing, download performance and even downtime. However, the cost of satellite outweighs benefits when it comes to closing the digital divide, considering the initial outlay of $349 and then $120 per month, satellite broadband is out of reach for many Americans.

Read more of our coverage of the satellite market here.